Another investing year has passed, and now that the 2015 dust has settled, it's time to look back at my dividend growth retirement account, which I call the Chump IRA, and progress toward my goals for the portfolio. The Chump IRA was born from numerous 401k rollovers throughout my career. When I left a company, I would roll the 401k into a self directed IRA, then start another 401k with my new employer. New investment dollars go from my paycheck to my 401k. The IRA receives no new outside money. In 2012, I decided to convert the IRA, which contained a hodgepodge of stocks, mutual funds, and cash, into a dividend growth portfolio. I publish an article at least yearly to update the portfolio performance.

My analysis will attempt to review the following items:

- Goals for the portfolio

- Performance vs. S&P 500

- Projected income and income growth

- Projected value of the fund 13 years out (age 65 for me)

- Analysis of individual holdings

- Trades and rationale (if any exists)

- Summary thoughts, and strategy for 2016

Looking back at the portfolio goals I wrote for the IRA in 2012, here is the summation:

- Create a portfolio of 30 individual stocks, great companies only

- All stocks should pay a growing dividend

- Grow the principle to $3M by 2029 (ambitious, but I still have 13 years)

- Grow the income from the portfolio to $120k/year by 2029

- Buy only high quality, undervalued stocks

- Sell or reduce exposure when the stocks are overvalued

- Keep around 10% cash in the portfolio

Generally, these are fine goals, but I don't refer to them all that often. Adding great dividend growth companies at good valuations, then trimming when they get too expensive are my main tenets.

Portfolio performance for the past 5 years, as measured by total value, is shown in the following graph:

The portfolio total return was down slightly in 2015, while the broad US equity market was up slightly. Comparing annual performance to the S&P 500, the portfolio has been running slightly behind the broad index since 2011, with a CAGR (compound annual growth rate) from 2011 through 2015 of 9.4% (vs. S&P at around 11%). For the four year period 2011 - 2015, the IRA is up 59.14% vs. a total return for the US market of 62.3% over the same period (source: Morningstar).

And while the value of the portfolio dropped a bit vs. the S&P 500, which finished up around 1.4% with dividends, the income growth of the IRA kept chugging along upwards as seen in the chart below:

The portfolio yielded around 3.2% in 2015, and year to year income rose 17.7%, another healthy year of income growth despite the lackluster capital appreciation. The CAGR for income growth from 2011 through 2015 is 17.22%.

At this point, I think it's fair to ask, "would I be better off just putting 100% of the money into VOO (Vanguard's S&P 500 ETF) and checking back 13 years from now?" For many folks, the answer is probably yes. For me, it isn't yes yet. Why? Well, I have a few reasons:

- The process of managing this portfolio for retirement is very educational. When I retire, I should be well prepared to effectively manage an income focused portfolio. If I simply started upon retirement, the learning curve would be steep and expensive...that's too risky for my taste. So I view this as excellent preparation for retirement.

- I'm getting better at investing every year, and over the next 13 years, I will begin to see performance that exceeds the total returns available through VOO or similar. If I keep recording my actions and learning, I believe I'll continue to improve. The education I've received managing this portfolio, has improved my performance in other portfolios I manage (like my own taxable investment account)

- Managing my own investments, and actively monitoring these investments, is fun. However, I recognize fully that I'd be doing better if I was able to devote more time to the portfolio.

Next, I've projected the income of the portfolio out several years.

The chart below shows how my income can grow at different dividend growth rates. My start point was the income from 2013 (the year I put this chart together). I've drawn a box around the two values closest to my 2015 income to show the "pace" of my income growth:

The pace of income growth for the portfolio is at the high end of the chart, and for 2015 I received $18,542 in income, a healthy increase between the 15% and 20% income growth columns. If I can keep the income growth at 15% or more, I'll reach my goal of $120k per year in income two years ahead of schedule, by 2027.

My target for principle is $3M, if I assume annual average growth of 8% between now and 2029, and no new money deposited, I can project my total account value to be:

This is a pretty conservative growth estimate. If the income from the portfolio stays above 3% over this period, then I only need to average 5% capital appreciation. The majority of the stocks I buy are forecasting far faster earnings growth than 5%, so I feel comfortable with this forecast, barring a prolonged recession.

If I can average 8% returns for the next 13 years, I'll reach $1.7M, far short of my goal of $3M. To get to $3M by age 65, I would need to average 12.5% annual total returns going forward, which is much more challenging, and probably unrealistic.

But if I stay focused on growing the income near 15% via dividends every year, I could argue that I'll reach my income goal, and along the way, will probably enjoy pretty great capital appreciation. For me, this has become the key reason for a dividend growth strategy in this portfolio. By focusing on the dividend growth metric, easily measured and achieved, earnings growth and subsequent capital appreciation must follow.

The expected income projection implies (if I divide $165k by 3%), a principle value attained of over $5M...so one of the projections seems unlikely, perhaps I'm understating my principle growth! My working assumption is that if I stay focused on growing the income at above 15%, I'll have to own stocks that are growing earnings by at least this same amount, which in turn, will translate into share price growth that keeps pace with the earnings growth, per every FASTGraphs chart I've looked at ever. This is my working hypothesis, and I'm sticking with it.

Given this precept, I need to own stocks with good income growth rates, and solid forecast earnings growth. In the following chart, which shows all of the portfolio holdings, I can review status of each individual holding:

The Chump IRA currently owns 34 stocks. The chart above shows weighting, one year price performance, recent yield, one year dividend growth, and the sum of the yield and dividend growth (Chowder Rule). The one year performance numbers are a bit misleading; I sold several names that did quite well in 2015, which aren't shown, and several of the poor performers were purchased late in the year when valuations were attractive.

KMI, BBL, ADM, CSX, and CVX really dragged on the portfolio. All can be traced to falling energy prices with the exception of ADM.

Looking at dividend growth, I'd like to keep the income growing at 15%, so if I look at stocks with only a low single digit increase this past year, or a cut, here is my list:

- BBL, KMI, EMR, STAG, SO, AFL, DOV, DLR, O, T

For the high yielders like DLR (REIT), O (REIT), STAG (REIT) SO (utility), and T (quasi-utility), I expect only modest increases, but am rewarded with high current yields. I need a few of these in the portfolio to keep the absolute income numbers up. This leaves BL, KMI, EMR, DOV and AFL as my laggards. EMR, DOV, and AFL are dividend champions, and all three are facing temporary headwinds from oil services exposure (EMR, DOV), and unfavorable forex (AFL). Nothing to panic over, but I'll remain watchful. Regarding BBL and KMI, both have slashed their dividends due to a very difficult business environment, so I'm inclined to replace these names in 2016.

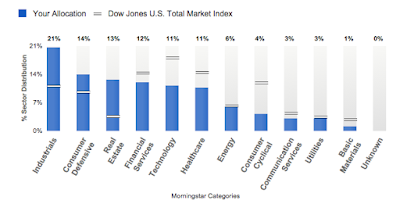

One additional statistic of interest to me is diversification. I'm trying to beat the S&P 500 over long periods, so I like to see how my overall portfolio is weighted vs. the benchmark. My Fidelity site has a nice graphic that shows this for the portfolio:

Putting these figures into a simple table quantifies my over/under weighting vs. the benchmark, with yellow highlighting my overweights and green my underweights:

From these data, I can see that the IRA is overweight in industrials, consumer defensive, and real estate, while underweight technology, consumer cyclical and healthcare. But what should I do about these weighting discrepancies? Shouldn't I be overweight in sectors offering the best values? And conversely, underweight those that are overvalued? Actually, I'm not sure. I can see the wisdom of loading up on un-loved sectors, and I can see the value of having a balanced, diverse group of stocks.

My sense is that it's a matter of priority. For me, 1) buy the stocks of great companies that are at or below fair value, and 2) own great companies across all of the S&P sectors, but not if it violates 1), and 3) use sector diversification as a tie breaker between stocks I'd like to own.

I was definitely overweight energy this time last year, and it hurt my 2015 results pretty strongly. At the time, none of my energy stocks was over-valued based on projected earnings, but none of these companies predicted a massive and prolonged reduction in oil prices. Thus the danger of holding too many names tied to a single sector of the S&P.

As a buy and hold investor, I've started to track my annual trades to verify that in fact, I am a buy and hold investor. Here are my trade statistics for 2015:

I was a bit surprised to see how many trades I made during the year. When you consider that no new money is entering the account, only money from dividends and closed positions are available to buy stocks. I tend to think of myself as a buy and hold investor, but 16 trims/sells argues that I may not be quite as patient as I think! Here is a brief summary of my sells/trims:

- Sold Walmart at $83, slowing dividend growth, slow growth forecasts

- Sold Baxter at $72, slow growth projections, overlap with JNJ, general impatience on my part

- Sold ConocoPhillips at $66 (bit of irony there), falling energy prices had me worried about their dividend (May), decided to sell and replace immediately with XOM with their superior balance sheet

- Sold Halliburton at $37.43, energy was still falling (September), maybe still is, low dividend, pending acquisition of Baker Hughes for a pre-selloff price (too high) was driving me crazy

- Sold Walgreens at $95, like the company but the price just got way ahead of earnings growth and the announced purchase of Rite Aid created a great selling opportunity

- Sold MCD at $118, like the company, but felt the price outran the projected earnings growth by more than two years, so I closed to redeploy in other more under-valued stocks

- Trimmed KMI at $42 down to a 1/2 position due to nervousness...well played.

On the buy side, I used the substantial cash generated from selling to to a lot of averaging down on cost with existing holdings, and added a few new stocks during the year including:

- Industrials; added UTX, UNP, CMI

- Energy; added (swap for COP) XOM

- Healthcare; added AMGN, ANTM

- Real Estate; added DLR, STAG

To summarize 2015, I feel like I made some pretty good moves with timely trims, sells at good valuations, and buys at fair to under valuations. The portfolio got hammered by falling energy prices, in excess of the S&P because I had a higher allocation to energy earlier in 2015, which unfortunately, has self corrected! Dividend income has been consistent, and growing nicely, per my plan. Versus the S&P 500, I was off by around 3% in comparison, which I'd like to correct in future years. Some of my learnings from 2015:

- Selling stocks you've held for many years is very hard (e.g. MCD, WBA)

- Sell stocks "robotically" without emotion, when they are overvalued (2-3 years ahead of forecast earnings growth), or when they have a dim future for the next couple of years

- Don't be tempted by lower quality, or non-dividend payers in this portfolio (I was)

- Keep the portfolio balanced across the sectors, with an emphasis on undervalued stocks

- Know your exposure to all sectors; many of my industrial holdings are dependent on the Energy sector for a portion of their revenues

- Don't let the number of stocks get too big, its hard to follow so many closely

- Lower the portfolio risk by selling overvalued stocks, and buying undervalued stocks

Looking ahead, 2016 has started with declining prices across most every segment, which is creating some nice buy opportunities. Unfortunately, since no new money is coming into the portfolio, I would need to sell something if I want to buy.

Before I sell anything, I want to a have a replacement ready to go. For this, I need an updated watch list of great companies, organized by sector, with my buy price clearly identified. I started this type of list in 2012, and have added to it over the years, but today, the list is badly neglected and out of date, so I find myself ill-prepared to act decisively as the market drops.... add this to my list of learnings! Time to update my watch list.