Shares of Qualcomm, QCOM jumped around 15% late last week on news that Broadcom will try to buy them. I've been holding QCOM for a couple of years, enjoying the dividends, but not much price appreciation in the stock. A few months ago, QCOM announced they would acquire NXPI for tens of billions of dollars.....

Now, with the stock up 21% from last week lows, I'm selling all my shares. The way I see this playing out is either:

A) Qualcomm moves to block the sale to Broadcom by over paying for NXPI, which would effectively act like a poison pill, and add a huge debt load to the company -or-

B) Broadcom pulls off the deal, in which case the recent run up in the stock price is near it's peak....

I'm not seeing a lot of upside to holding QCOM...time to redeploy elsewhere.

Best,

Chump

Investing for retirement, general financial advice and lessons learned, and occasional opinions on anything and everything.

Monday, November 6, 2017

Friday, October 27, 2017

Adding to Simon Property Group (SPG)

Adding to my SPG position today at around $157/share. I started my position in SPG last year at $166, and have added chunks at lower prices, the lowest was $152. The stock has been rising slowly since then, and they just reported an excellent quarter yesterday. Today, retail is getting hit hard because JC Penney is reporting abysmal numbers, and SPG is down around 3.5% as a I write this....

Here is yesterday's SPG report summary:

This purchase takes me to a very full position in the stock, with a current dividend yield of 4.56%. Love it.

Chump

Here is yesterday's SPG report summary:

This purchase takes me to a very full position in the stock, with a current dividend yield of 4.56%. Love it.

Chump

Wednesday, October 25, 2017

S&P 500 Put, Stop Loss Triggers, Recent Adds (SJM)

So, how to hedge a big IRA portfolio? Or should you bother if you are still 7 years away from your retirement age goal? This has been on my mind lately.

- The S&P500 PE is up over 25 lately, at historically high levels. We haven't had a correction of 3% or more in nearly a year (11.5 months), and a 5% correction since well before that (18 months)

- I don't own the S&P500 ETF in my IRA, so that's good.

- I tend to buy undervalued stocks, and sell overvalued stocks, so that's good.

- I do own a handful of names that are pretty overvalued, but continue to climb, so I hesitate to sell these, and they've grown large in the portfolio (GD, JNJ, MO, PM, JPM, PSX, ABBV, CVX), which is bad if a correction comes soon...

Here are the measures I've taken to be a bit more prudent in the short run:

- I bought an S&P put slightly out of the money at 2540, with an expiration of December 29, 2017.

- This is liking having a short position for $250,000 worth of S&P "stock." If the market drops 10%, this put would gain around $25,000 in value.

- The cost for this put was around $4200

- If the market remains positive, the put will expire worthless, and I'll have flushed $4200

- As I write this, the market is down around 0.75% today, the put is up 40% today, slightly above the price where I purchased it....

- For the stocks mentioned above that are overvalued, I put in stop loss orders for several (JNJ, GD, CVX so far)

- I placed limit orders for a 3% trailing stop loss vs. last price.

- If any of these drops 3%, the order becomes a limit at the price that's 3% below last closing price.

- The orders are only to trim down to a "full" position in the portfolio

- As of this blog post, GD has triggered (did so on 10-19-17) at a price of $207.75, which is above today's price, so that was good.

Shifting gears, I like SJM again today, and have added another chunk. FASTGraph below:

Regards,

Chump

Tuesday, September 19, 2017

Updating My Investing Rules.....

I've been thinking about the rules I wrote when I started this Dividend Growth IRA. I went back and looked at the rules I wrote in 2012, and here they are:

1. I've eliminated the "core" and "non-core" designations. This is tough to track and doesn't make a ton of sense anymore. I have a taxable account where I invest in lower yielding stocks, and that serves as the non-core. Today, I only invest in 2.5% yield or higher stocks for this account (usually)

2. The 10% cash goal is still valid, and I'm a little light today. I need to trim some of my larger/overpriced names.

3. I still only add stocks at nice undervaluation, so that's been good. I'm a bit slow to sell stocks if they are 15% overvalued. I'll need to change that to higher overvaluation number, perhaps 30% or so. I also rarely use stop losses. I find they don't work too well, and usually get triggered, then the stock recovers quickly.

4. There are other factors I like to look at these days, among them are:

- Debt level (50% or less preferred)

- Credit rating (at least BBB+)

- Morningstar rating (4* or better is what I usually require)

- ROIC, lately looking for higher than 10% here...though a soft target

- Revenue. In addition to eps growth, I also like to see a growing revenue line

- Insider action (I like to see insiders buying the shares, and especially hate to see them selling)

- I also read the 10Q for the latest 2 quarters carefully, this is usually instructive, and gives me a feel for the CEO and whether or not she is a "bullshitter"

Friday, September 8, 2017

Selling AFL, Buying SJM

Put orders in today to sell my position in AFL, and start a position in SJM

AFL has been a decent performer, and is a modestly overvalued today. The dividend is down to 2.14%, and also hold a larger position in my taxable account. As a result, I'm closing the AFL position in favor or something more undervalued with a better yield.

Enter Smucker (SJM). JM Smucker came to attention today via Chuck Carnivale, article here:

https://seekingalpha.com/article/4105099-choosy-investors-choose-j-m-smucker-dividend-adds-value

Thoughts on the matter:

In short, this is an upgrade from my AFL holding here, a more defensive stock, and a better fit for my retirement portfolio given the higher yield, around 2.95% today.... Added the stock at $107, 1/2 position.

Best,

Chump

AFL has been a decent performer, and is a modestly overvalued today. The dividend is down to 2.14%, and also hold a larger position in my taxable account. As a result, I'm closing the AFL position in favor or something more undervalued with a better yield.

Enter Smucker (SJM). JM Smucker came to attention today via Chuck Carnivale, article here:

https://seekingalpha.com/article/4105099-choosy-investors-choose-j-m-smucker-dividend-adds-value

Thoughts on the matter:

- AFL is a big position in two accounts. Closing out one makes sense, and reduces risk

- Growth prospects are better for SJM

- Yield higher for SJM

- AFL is a bit overvalued today, has a low yield, and is very stingy with dividend increases

- I recently opened a position in ORI, another insurance name, so I feel fine closing AFL in the Chump account

- SJM is a more defensive stock, and should fair well if the market tanks, or the economy slows

In short, this is an upgrade from my AFL holding here, a more defensive stock, and a better fit for my retirement portfolio given the higher yield, around 2.95% today.... Added the stock at $107, 1/2 position.

Best,

Chump

Wednesday, August 30, 2017

Market Lessons in Charts That You Can Hang On Your Wall!

Monday, August 28, 2017

What Do the Best Investors Do that the Rest Don't? Great Little Article

https://behavioralvalueinvestor.com/blog/2017/8/27/what-do-the-best-investors-do-that-the-rest-dont

Charlie Munger, the Vice Chairman of Berkshire Hathaway and Warren Buffett’s partner said

something simple yet profound at the 2017 Berkshire Hathaway Annual Meeting: “A lot of

other people are trying to be brilliant and we are just trying to stay rational. And it’s a big

advantage.” Some might think that becoming an excellent investor requires off-the-charts

intelligence or some highly proprietary model that leads to an edge that nobody else can

replicate. That is not what experience has shown.

Here are some traits and behaviors that have allowed investors to excel over the long-term:

1. Temperament. Temperament is the most important quality for an investor to have. My

observation of many investors over my 15+ years of professional investing has led me to

believe that temperament cannot be learned, but rather it is an innate characteristic of

one’s personality. Some people are able to remain rational and continue to follow their

process even under great duress or during periods of external upheaval. Others get

swept up in the emotion that typically runs amok during such circumstances, and

abandon their discipline.

2. Ability to do nothing most of the time. Most of the time there are few good investments

that combine sufficient business quality with a large margin of safety in the form of a

large gap between price and intrinsic value. That doesn’t mean that great investors are

spending all of their time relaxing on the beach – to the contrary, they are typically

avariciously reading and studying business and industries, preparing for the moment

when securities of companies they understand well can be purchased at attractive

prices. It does mean that they make investments infrequently, and that most of the time

when they look at a potential opportunity they end up passing. Those who are unable to

maintain this state of low activity frequently end up making questionable investments to

satisfy their desire to do something, and more often than not it is their brokers who are

the biggest beneficiaries of their elevated activity levels.

3. Accumulation of mental models. Understanding different disciplines helps great

investors look at questions of business analysis in new ways. While studying economics

and industry-specific information can certainly help, the best investors also use insights

from other fields to reach better decisions.

4. Focus on process over outcome. Benjamin Graham wrote: “In the short-term the market

is a voting machine, but in the long-term it is a weighing machine.” What he meant was

that in the short-term security prices fluctuate purely based on the opinions of market

participants, and can deviate widely from the underlying business values. In the longterm,

it is the company’s assets and cash flows that determine its value and exert a

force of gravity upon the price of its securities. With security prices available on a minute-

by-minute basis, the run-of-the-mill investors focus on analyzing randomness – allowing

themselves to become happy or sad over short-term price fluctuations that are

disconnected from whether they were fundamentally right in their investment analysis.

The best investors work hard to not be affected by the short-term price fluctuations, and

instead focus on both improving their process and consistently executing it. Over the

long-term their performance is a result of the quality of their process and of the

consistency with which they execute it.

5. Minimizing behavioral biases. Behavioral biases are pervasive and nearly impossible to

eliminate, but the best investors work hard to be consciously aware of them and to take

specific steps to mitigate them. As I wrote in Behavioral Defense in Decision Making,

there are a number of steps one can take to stay as unbiased as possible. One of my

favorites is to consciously seek out the strongest possible opposite point of view that

contradicts my thesis. If done well, this can lessen the impact of many biases, such as

anchoring, over-confidence and base-rate neglect.

I frequently get asked by prospective investors about what my ‘edge’ is as an investor.

Sometimes I think the answer that they are looking for is some proprietary model, some

black-box that spits out superior answers that nobody possesses, or an ability to know what

the future holds based on some deeply proprietary network of sources. The real answer is

less exciting, but nonetheless quite effective. It is the combination of the traits and

behaviors that I described above. I would add a sixth one to the list – staying humble while

maintaining your confidence. History is littered with many seemingly great investors who fell

apart and produced disappointing results for their clients just as they had accumulated the

greatest amount of assets after a good run of performance. Perhaps some of them were

never as great as they seemed, but in other cases I can’t help but think that it was a

combination of hubris and complacency that led them astray.

The best investors stay humble – always thirsting to learn and improve as well as accepting

that they are fallible and can make mistakes. This helps them to be on guard against the

traps of complacency and overconfidence. Some view this posture as inconsistent with

confidence in one’s abilities – after all, this is an industry where some think that the best

investors are supposed to be on CNBC or on the cover of some financial magazine telling the

world how great they are, which seems incompatible with a humble, introspective approach.

Believe me, the people I admire most as investors have rejected this false dichotomy, and

are able to balance humility with confidence and competence in a way that allows them to

continue to improve for many years.

About the Author

Gary Mishuris, CFA is the Managing Partner and Chief Investment Officer of Silver Ring Value

Partners, an investment firm with a concentrated long-term intrinsic value strategy. Prior to

founding the firm in 2016, Mr. Mishuris was a Managing Director at Manulife Asset

Management since 2011, where he was the Lead Portfolio Manager of the US Focused

Value strategy. From 2004 through 2010, Mr. Mishuris was a Vice President at Evergreen

Investments (later part of Wells Capital Management) where he started as an Equity Analyst

and assumed roles with increasing responsibilities, including serving as the co-PM of the

Large Cap Value strategy between 2007 and 2010. He began his career in 2001 at Fidelity

as an Equity Research Associate. Mr. Mishuris received a S.B. in Computer Science and a

S.B. in Economics from the Massachusetts Institute of Technology (MIT).

What Do the Best Investors Do That the Rest Don’t?

by Gary Mishuris, CFA

something simple yet profound at the 2017 Berkshire Hathaway Annual Meeting: “A lot of

other people are trying to be brilliant and we are just trying to stay rational. And it’s a big

advantage.” Some might think that becoming an excellent investor requires off-the-charts

intelligence or some highly proprietary model that leads to an edge that nobody else can

replicate. That is not what experience has shown.

Here are some traits and behaviors that have allowed investors to excel over the long-term:

1. Temperament. Temperament is the most important quality for an investor to have. My

observation of many investors over my 15+ years of professional investing has led me to

believe that temperament cannot be learned, but rather it is an innate characteristic of

one’s personality. Some people are able to remain rational and continue to follow their

process even under great duress or during periods of external upheaval. Others get

swept up in the emotion that typically runs amok during such circumstances, and

abandon their discipline.

2. Ability to do nothing most of the time. Most of the time there are few good investments

that combine sufficient business quality with a large margin of safety in the form of a

large gap between price and intrinsic value. That doesn’t mean that great investors are

spending all of their time relaxing on the beach – to the contrary, they are typically

avariciously reading and studying business and industries, preparing for the moment

when securities of companies they understand well can be purchased at attractive

prices. It does mean that they make investments infrequently, and that most of the time

when they look at a potential opportunity they end up passing. Those who are unable to

maintain this state of low activity frequently end up making questionable investments to

satisfy their desire to do something, and more often than not it is their brokers who are

the biggest beneficiaries of their elevated activity levels.

3. Accumulation of mental models. Understanding different disciplines helps great

investors look at questions of business analysis in new ways. While studying economics

and industry-specific information can certainly help, the best investors also use insights

from other fields to reach better decisions.

4. Focus on process over outcome. Benjamin Graham wrote: “In the short-term the market

is a voting machine, but in the long-term it is a weighing machine.” What he meant was

that in the short-term security prices fluctuate purely based on the opinions of market

participants, and can deviate widely from the underlying business values. In the longterm,

it is the company’s assets and cash flows that determine its value and exert a

force of gravity upon the price of its securities. With security prices available on a minute-

by-minute basis, the run-of-the-mill investors focus on analyzing randomness – allowing

themselves to become happy or sad over short-term price fluctuations that are

disconnected from whether they were fundamentally right in their investment analysis.

The best investors work hard to not be affected by the short-term price fluctuations, and

instead focus on both improving their process and consistently executing it. Over the

long-term their performance is a result of the quality of their process and of the

consistency with which they execute it.

5. Minimizing behavioral biases. Behavioral biases are pervasive and nearly impossible to

eliminate, but the best investors work hard to be consciously aware of them and to take

specific steps to mitigate them. As I wrote in Behavioral Defense in Decision Making,

there are a number of steps one can take to stay as unbiased as possible. One of my

favorites is to consciously seek out the strongest possible opposite point of view that

contradicts my thesis. If done well, this can lessen the impact of many biases, such as

anchoring, over-confidence and base-rate neglect.

I frequently get asked by prospective investors about what my ‘edge’ is as an investor.

Sometimes I think the answer that they are looking for is some proprietary model, some

black-box that spits out superior answers that nobody possesses, or an ability to know what

the future holds based on some deeply proprietary network of sources. The real answer is

less exciting, but nonetheless quite effective. It is the combination of the traits and

behaviors that I described above. I would add a sixth one to the list – staying humble while

maintaining your confidence. History is littered with many seemingly great investors who fell

apart and produced disappointing results for their clients just as they had accumulated the

greatest amount of assets after a good run of performance. Perhaps some of them were

never as great as they seemed, but in other cases I can’t help but think that it was a

combination of hubris and complacency that led them astray.

The best investors stay humble – always thirsting to learn and improve as well as accepting

that they are fallible and can make mistakes. This helps them to be on guard against the

traps of complacency and overconfidence. Some view this posture as inconsistent with

confidence in one’s abilities – after all, this is an industry where some think that the best

investors are supposed to be on CNBC or on the cover of some financial magazine telling the

world how great they are, which seems incompatible with a humble, introspective approach.

Believe me, the people I admire most as investors have rejected this false dichotomy, and

are able to balance humility with confidence and competence in a way that allows them to

continue to improve for many years.

About the Author

Gary Mishuris, CFA is the Managing Partner and Chief Investment Officer of Silver Ring Value

Partners, an investment firm with a concentrated long-term intrinsic value strategy. Prior to

founding the firm in 2016, Mr. Mishuris was a Managing Director at Manulife Asset

Management since 2011, where he was the Lead Portfolio Manager of the US Focused

Value strategy. From 2004 through 2010, Mr. Mishuris was a Vice President at Evergreen

Investments (later part of Wells Capital Management) where he started as an Equity Analyst

and assumed roles with increasing responsibilities, including serving as the co-PM of the

Large Cap Value strategy between 2007 and 2010. He began his career in 2001 at Fidelity

as an Equity Research Associate. Mr. Mishuris received a S.B. in Computer Science and a

S.B. in Economics from the Massachusetts Institute of Technology (MIT).

Tuesday, August 15, 2017

Portfolio Composition on 8-04-2017

Here are the holdings in the Chump portfolio today:

38 stocks, and 3% cash. Total portfolio yield is around 3.3%.

38 stocks, and 3% cash. Total portfolio yield is around 3.3%.

Tuesday, July 18, 2017

Looking at Old Republic International (ORI)

I recently screened the current world of Dividend Aristocrats of which there are 108. Companies that have continued to increase the dividend for 25 years or more. My screen was a simple PE vs. Normal PE screen. Here are the top results (via FASTGraphs):

From the screen above, Old Republic International, ORI, caught my attention with the lowest blended PE on the list.

ORI is a 94 year old insurance company based in Chicago, IL. They have been paying a dividend since 1942, and have been increasing the dividend for the past 35 years straight.

I next took a look at ORI's 2016 CEO letter and 10K from the company website, and have attached the link below. For those considering an investment in the stock, these are worth reading in their entirety.

http://www.oldrepublic.com/2016_ar_10k_proxy.pdf

From these data, I note the following:

Prior to the recession, they were maintaining a payout ratio of around 25%, and increasing dividends at a nice pace. During the recession, when earnings and cash flow suffered, they continued to pay and increasing dividend, only 1% increases, while the payout ratio ballooned to 182% in 2012. Since 2012, the business has stabilized, and the payout ratio is dropping. Perhaps a larger increase in the dividend will begin as the payout ratio reaches a more normal historical level?

Here is a look at the forecasted growth and cash flow:

Growth projections merit a higher PE estimate or expansion to 15. At PE 15, the return on revenue, or ROR, is estimated to hit 18.5% annually by the end of 2018.

Taking another look at the valuation today, with a six year history to reflect more recent operations and the market's valuation of the stock give this FASTGraph:

Since 2012, the average PE of the stock as been around 14.7. Today's price provides a discount to fair value of roughly 10%, so I view this as a good time to initiate a position.

Insiders are supporting the stock recently as well. Looking at insider transactions since the start of 2016 yields the following chart, showing some buys by both Directors and the CEO at prices between $16.50 - $19.56....

Based on my analysis of this stock, and its current valuation, I initiated a position in the stock on July 18, at a price of $19.52.

I'll finish with the outlook for ORI as stated in the recent CEO letter from March, 2017:

"Assessing the current insurance scene and the competitive forces at work makes us very comfortable with our state of affairs. We are not and have no aspiration to be among the biggest in our industry. But we’re confident in our ability to compete toe-to-toe with those players. Our current capitalization is more than enough to 1) provide a necessary financial cushion, and 2) add capital to individual subsidiaries so they may take advantage of existing and new opportunities.

As long-term observers and practitioners in insurance, we have a great appreciation for the merits of purposeful rather than growth “because we can.” Acquisitions – many of which we’ve done over the decades – can be a good way to add impetus, access new approaches to organic growth, and fill product distribution channels gaps. But acquisitions can also bring problems and cultural differences that may be so intractable as to distract management’s attention from a wellknown and reliably performing enterprise. To us, the bottom line is that we see very little of worth to acquire in today’s insurance landscape.

The preferred sources of growth, however, will continue to come from our existing business. They will spring from the relationships, intellectual capital, and independent mindset that our people bring to the table. It will come from Old Republic’s good name, and its reputation for being a good place to do business. We’re convinced that ideas will arise that will be a fit with our culture, values, and dedication to doing things right for customers and shareholders alike. With all this, we plan to support and enhance organic growth, and to sponsor highly focused, specialty underwriting ventures (as we last did early in 2015). Most of the operating challenges encountered during the Great Recession years and their lingering aftermath are behind us.

We’re optimistic that our Company is on track to see positive performance which will benefit our customers and serious investors in our stock."

Respectfully submitted on behalf of the Board of Directors, Aldo C. Zucaro Chairman and Chief Executive Officer Chicago, Illinois March 10, 2017

From the screen above, Old Republic International, ORI, caught my attention with the lowest blended PE on the list.

ORI is a 94 year old insurance company based in Chicago, IL. They have been paying a dividend since 1942, and have been increasing the dividend for the past 35 years straight.

I next took a look at ORI's 2016 CEO letter and 10K from the company website, and have attached the link below. For those considering an investment in the stock, these are worth reading in their entirety.

http://www.oldrepublic.com/2016_ar_10k_proxy.pdf

Here are some of my takeaways from these materials:

- ORI historically provided insurance products for three main segments: General Insurance, Mortgage Insurance (MI), and Consumer Credit Insurance (CCI)

- The financial crisis in 2008 hit the MI and CCI segments of ORI pretty hard, thus a big increase in claims for the years 2009-2011, which is reflected in their historical financials

- Since that time, they've re-classified these segments as "run-off" businesses, which means they continue to operate, but will be phased out over time, and resources will be invested in growing the General Insurance and other new insurance segments

- One area of new growth is title insurance, which has been growing rapidly

- A second area of new growth is accident and life insurance, which is just getting started

- The culture of the ORI seems very employee and shareholder friendly, and employees own 9% of the company via various compensation and retirement plans

- The company prefers to grow organically, and is not pursuing questionable acquisitions

- The company is managed very conservatively, and is focused on maintaining a strong balance sheet to weather difficult times

- ORI and the leadership team are committed to the dividend, but while its never been halted or cut, it has only been increasing by a penny a year since the financial crisis

Here is a summary of their focus segments going forward, and target % contribution to the business (from the 10K):

And from an update on their website dated June, 2017, here is a recent snapshot summary:

Based on the book value above, the Price/Book ratio for ORI is an attractive 1.11 (stock trading right around the $19.56 as I write this).

Based on the book value above, the Price/Book ratio for ORI is an attractive 1.11 (stock trading right around the $19.56 as I write this).

A 20 year FASTGraph for ORI follows:

From these data, I note the following:

- Operating results look good prior to, and a few years after the great recession

- This firm was particularly hard hit by the financial crisis

- Operating results seem to have stabilized since 2012

- The stock is currently trading at a reasonable valuation

- Market cap of $5B, good credit rating of BBB+, and a low level of debt at 24%

- Dividend yield is excellent at 3.9%

- And of course, this is a Dividend Aristocrat...they continued to pay and raise the dividend throughout the financial crisis and difficult times. 35 straight years with an annual increase

Prior to the recession, they were maintaining a payout ratio of around 25%, and increasing dividends at a nice pace. During the recession, when earnings and cash flow suffered, they continued to pay and increasing dividend, only 1% increases, while the payout ratio ballooned to 182% in 2012. Since 2012, the business has stabilized, and the payout ratio is dropping. Perhaps a larger increase in the dividend will begin as the payout ratio reaches a more normal historical level?

Here is a look at the forecasted growth and cash flow:

Growth projections merit a higher PE estimate or expansion to 15. At PE 15, the return on revenue, or ROR, is estimated to hit 18.5% annually by the end of 2018.

Taking another look at the valuation today, with a six year history to reflect more recent operations and the market's valuation of the stock give this FASTGraph:

Since 2012, the average PE of the stock as been around 14.7. Today's price provides a discount to fair value of roughly 10%, so I view this as a good time to initiate a position.

Insiders are supporting the stock recently as well. Looking at insider transactions since the start of 2016 yields the following chart, showing some buys by both Directors and the CEO at prices between $16.50 - $19.56....

Based on my analysis of this stock, and its current valuation, I initiated a position in the stock on July 18, at a price of $19.52.

I'll finish with the outlook for ORI as stated in the recent CEO letter from March, 2017:

Old Republic’s Outlook is Very Positive

"Assessing the current insurance scene and the competitive forces at work makes us very comfortable with our state of affairs. We are not and have no aspiration to be among the biggest in our industry. But we’re confident in our ability to compete toe-to-toe with those players. Our current capitalization is more than enough to 1) provide a necessary financial cushion, and 2) add capital to individual subsidiaries so they may take advantage of existing and new opportunities.

As long-term observers and practitioners in insurance, we have a great appreciation for the merits of purposeful rather than growth “because we can.” Acquisitions – many of which we’ve done over the decades – can be a good way to add impetus, access new approaches to organic growth, and fill product distribution channels gaps. But acquisitions can also bring problems and cultural differences that may be so intractable as to distract management’s attention from a wellknown and reliably performing enterprise. To us, the bottom line is that we see very little of worth to acquire in today’s insurance landscape.

The preferred sources of growth, however, will continue to come from our existing business. They will spring from the relationships, intellectual capital, and independent mindset that our people bring to the table. It will come from Old Republic’s good name, and its reputation for being a good place to do business. We’re convinced that ideas will arise that will be a fit with our culture, values, and dedication to doing things right for customers and shareholders alike. With all this, we plan to support and enhance organic growth, and to sponsor highly focused, specialty underwriting ventures (as we last did early in 2015). Most of the operating challenges encountered during the Great Recession years and their lingering aftermath are behind us.

We’re optimistic that our Company is on track to see positive performance which will benefit our customers and serious investors in our stock."

Respectfully submitted on behalf of the Board of Directors, Aldo C. Zucaro Chairman and Chief Executive Officer Chicago, Illinois March 10, 2017

Tuesday, July 11, 2017

Selling Coca-Cola

I sold my full position in KO today, price was $44.42. I bought the stock back in 2011, have have a cumulative gain in the stock since then of around 28%, which trails the S&P 500 significantly over the same period. Here is a FastGraph for KO:

What concerns me about KO is their shrinking top line. They've been losing sales for 5 consecutive years, and seem unable to turn it around. They've also had declining EPS since 2013, and they are borrowing money to buy back back shares. This is increasing their debt, and artificially inflating their EPS. Not a recipe for long term success.

Further, from a big picture standpoint, I think increasingly, there is a war developing on sugar and sugary drinks, and at today's price, the stock is pretty significantly overvalued.

So I'm selling. I'm banking the cash for now until a better opportunity arrives.....I may dump the money into a telecom or utility for the dividends while a wait.

KO has been riding on its brand name for years.....too much risk for me.

Chump

What concerns me about KO is their shrinking top line. They've been losing sales for 5 consecutive years, and seem unable to turn it around. They've also had declining EPS since 2013, and they are borrowing money to buy back back shares. This is increasing their debt, and artificially inflating their EPS. Not a recipe for long term success.

Further, from a big picture standpoint, I think increasingly, there is a war developing on sugar and sugary drinks, and at today's price, the stock is pretty significantly overvalued.

So I'm selling. I'm banking the cash for now until a better opportunity arrives.....I may dump the money into a telecom or utility for the dividends while a wait.

KO has been riding on its brand name for years.....too much risk for me.

Chump

Tuesday, June 6, 2017

A Few Adds This Week PFE, SKT, KIM , SPG

When a dip presents, I'm occasionally adding to positions in the portfolio, I don't always post on the blog. In the past several days I've been adding to the following stocks:

- PFE

- SKT

- KIM

- SPG

I'm also eyeing two stocks to trim or sell... KO due to deteriorating fundamentals combined with overvaluation, and AAPL, just a trim, it's grown into an overly large single position at 4.9% of my IRA.... I'm currently paralyzed by indecision on both actions....

Best,

Chump

Prager U...Simply the Best

I absolutely love these short, compelling videos. I show them to my family and friends....

Here is the link: https://www.youtube.com/user/PragerUniversity

Regards,

Chump

Here is the link: https://www.youtube.com/user/PragerUniversity

Regards,

Chump

Friday, June 2, 2017

QVCA, An Interesting Analysis I Received Yesterday

Thoughtful analysis put together by a smart UCSD student....

Here is the link:

https://www.dropbox.com/s/alqm8qw913qbqha/LibertyInteractive%5B1%5D.pdf?dl=0

Here is the link:

https://www.dropbox.com/s/alqm8qw913qbqha/LibertyInteractive%5B1%5D.pdf?dl=0

Tuesday, May 16, 2017

Taking a Look at Berkshire and Baupost

Three of my favorite investors are Charlie Munger, Warren Buffet, and Seth Klarman. So I thought I would pull up their current investments and recent changes to their portfolio. It occurs to me that I should be checking what these legends are doing more frequently.

Here is the latest from Bershshire Hathaway:

I own fewer of these names, and only QCOM in my Chump IRA. I own ABC, ESRX, and MCK in my taxable account, but these pay small or no dividend. Interestingly, I owned FOXA as well, but sold it recently after the loss of Roger Ailes and Bill O'Reilly. This list gives me plenty to evaluate.

Best,

Chump

Here is the latest from Bershshire Hathaway:

Stocks I have in common with Berkshire are:

- WFC, AAPL, KO, PSX, GE, JNJ

- I hold 4 of his top ten, and sold IBM at a high last year, which I bet Warren wishes he had done

- I note they own three airlines, which surprises me a bit. Warren has been very negative on airlines throughout his career...."the quickest way to $1M in the stock market is to invest $2M into an airline stock...."

- I own one airline, ALK, and have been quite happy with it's performance.

- BH also owns 6 financial stocks, including Visa and Mastercard. Worth more analysis

- There are a few on the list I'm not familiar with, I'll check them out soon.

Best,

Chump

Friday, May 12, 2017

Adding to KIM, and Starting a Position is SKT

REITs continue to get hit today due to some bad news in the sector, and in retail. Some of the high quality REITs I already own are selling at a great discount, and Tanger Outlet REIT (SKT), is really at a great price. I'm adding to my existing position in KIM, and starting a position in SKT.

Here is a FASTGraph for SKT:

Here are the reasons I like SKT:

Here is a FASTGraph for SKT:

Here are the reasons I like SKT:

- Great price, undervalued

- 5% dividend yield

- Steady, consistent growth in cash flow the past 20 years!

- Excellent credit rating

I really like REIT investments for my IRA. The high dividends are not taxed, and I reinvest them directly. This creates a compounding machine for the portfolio. As a % of the overall portfolio, REITs now account for 17.2% of the portfolio. Here are my REIT holdings:

Best regards,

- O

- OHI

- STAG

- DLR

- KIM

- SKT

- SPG

I'm still looking to add at least one more REIT in the healthcare or storage spaces...I like PSA and HCA, but both are still above my buy point.......

Best regards,

Chump

Tuesday, May 9, 2017

Adding DOC (Physicians Realty Trust), Selling Lexington (LXP)

Here is an article on the REIT from Brad Thomas....

https://seekingalpha.com/article/4063591-physicians-realty-just-doctor-ordered

I've wanted to increase my ownership of healthcare REITs, with OHI as my only holding here. I looked at Ventas (VTR) and HTA, both good candidates, but both a bit too pricey for me today. DOC is trading at a nice discount to fair value, so that is my pick. I bought a 1/2 position in the stock today at a price of $19.12 per share. The yield today is around 4.7%.

Here is the FASTGraph for DOC:

https://seekingalpha.com/article/4063591-physicians-realty-just-doctor-ordered

I've wanted to increase my ownership of healthcare REITs, with OHI as my only holding here. I looked at Ventas (VTR) and HTA, both good candidates, but both a bit too pricey for me today. DOC is trading at a nice discount to fair value, so that is my pick. I bought a 1/2 position in the stock today at a price of $19.12 per share. The yield today is around 4.7%.

Here is the FASTGraph for DOC:

Regarding Lexington... they are having some issues financially, and while their long term prospects seem fine, I think it will be a year or two before the price really starts to appreciate. I've closed the position, and redeployed to DOC above.

Best regards,

Chump

Monday, May 8, 2017

Good Article from Brad Thomas on STAG

https://seekingalpha.com/article/4070428-bet-stag-feels-like-always-dreaming?v=1494269483&comments=show

Still a buy in his mind.

Best,

Chump

Still a buy in his mind.

Best,

Chump

Thursday, May 4, 2017

Adding in the REIT space - More Realty Income (O), and Simon Property Group (SPG)

REITs as a group are down today due some bad news for a triple net REIT that I don't own. But the entire sector is getting punished.

My position in O is smallish, at 3/4 of normal. The reason for this is that I trimmed O back from an oversized position to this undersized position on 6/26/2016 at a price of $68 and some change. At the time, I was worried about the size of my O position, and the high valuation. Here is a chart showing O's price from that day to today:

Selling at $68 was a good move. Buying back in at $54.97 could be a good move, we'll see. But one thing is certain, buying back the 110 shares I sold at $68, for a new price of $54.97, has saved me over $1,430, less dividends. The buy back gets me back to a full position. If O drops further, I'll build it back to where it was, which was a 5/4 position...

I'm also adding SPG today, good stock, good price, good dividend.

Best,

Chump

My position in O is smallish, at 3/4 of normal. The reason for this is that I trimmed O back from an oversized position to this undersized position on 6/26/2016 at a price of $68 and some change. At the time, I was worried about the size of my O position, and the high valuation. Here is a chart showing O's price from that day to today:

Selling at $68 was a good move. Buying back in at $54.97 could be a good move, we'll see. But one thing is certain, buying back the 110 shares I sold at $68, for a new price of $54.97, has saved me over $1,430, less dividends. The buy back gets me back to a full position. If O drops further, I'll build it back to where it was, which was a 5/4 position...

I'm also adding SPG today, good stock, good price, good dividend.

Best,

Chump

Wednesday, May 3, 2017

Sold KMI (finally), Added to TROW, KR

I finally closed my position in KMI....still overpriced, cut the dividend, prospects are a bit bleak for the near term future, and I could do better with the money.

Added to my positions in TROW and KR. Kroger is a value play, and TROW has some nice momentum after a good earnings report. Both are now 2/3 sized positions in the portfolio. As an FYI, TROW is in my Chump IRA, while KR is in my taxable account due to the smallish yield.

Best,

Chump

Added to my positions in TROW and KR. Kroger is a value play, and TROW has some nice momentum after a good earnings report. Both are now 2/3 sized positions in the portfolio. As an FYI, TROW is in my Chump IRA, while KR is in my taxable account due to the smallish yield.

Best,

Chump

Priceonomics: Craft Brewing in the USA

San Diego is a respectable 14th on the list!

https://priceonomics.com/where-is-craft-beer-most-popular-in-america/

Best,

Chump

https://priceonomics.com/where-is-craft-beer-most-popular-in-america/

Best,

Chump

Friday, April 28, 2017

Reflecting on my MCD Sale in December of 2015

I closed my position in MCD back in December of 2015. The blog I posted at the time can be found here: http://chumpmenudo.blogspot.com/2015/12/ or in the archives on the right side of this page.

Every time I look at my stock holdings and my watch list, I see MCD making new highs, which causes me some angst. This past February, after reading a book by Michael Lewis, I wrote an article about selling stocks (here: https://seekingalpha.com/article/4049789-buy-coke-interesting-book-recommendation) and how regret is such a strong emotion for investors, and how it can keep us from making smart investment decisions.

Should I regret selling MCD back in late 2015? The quick and easy answer is yes, I sold it at around $118, and today it's trading above $140, what a Chump I am!

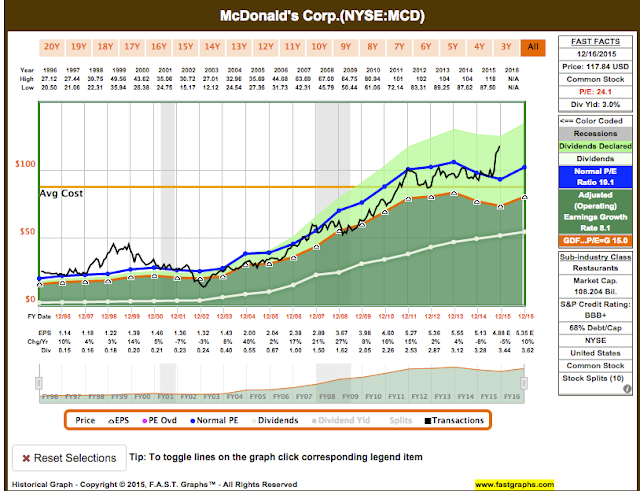

But wait, if you look more deeply at the decision, which would be impossible to do without a diary, log, or in my case, a blog, the story changes. Going back to my blog post from December 2015, I was concerned about the valuation of MCD. Looking at the FASTGraph for MCD from that time, I was right to be a little worried:

Every time I look at my stock holdings and my watch list, I see MCD making new highs, which causes me some angst. This past February, after reading a book by Michael Lewis, I wrote an article about selling stocks (here: https://seekingalpha.com/article/4049789-buy-coke-interesting-book-recommendation) and how regret is such a strong emotion for investors, and how it can keep us from making smart investment decisions.

Should I regret selling MCD back in late 2015? The quick and easy answer is yes, I sold it at around $118, and today it's trading above $140, what a Chump I am!

But wait, if you look more deeply at the decision, which would be impossible to do without a diary, log, or in my case, a blog, the story changes. Going back to my blog post from December 2015, I was concerned about the valuation of MCD. Looking at the FASTGraph for MCD from that time, I was right to be a little worried:

The price and PE had become disjointed from their earnings. In short, MCD was becoming a risky hold, and in my opinion, was likely to revert to a more normal historical PE in the coming year, from the then current PE 24 down to a more normal PE 19.

However, because I dislike selling quality stocks, I was inclined to hold on to MCD and continue to collect the dividend, unless I could identify a more attractive alternative. The fear of regret was holding my back! I was imagining selling MCD, then watching it go to $140!

At about this same time, I was reviewing my watch list favorable alternatives. I had read a good article by Brad Thomas, actually several, touting the virtues of a REIT called Stag Industrial, so it was on my watch list. (As an interesting aside, I noticed Brad has written about STAG 32 times on SA. The only REITs with more coverage from Brad are O and VER) After doing some research, I determined that I would shift by investment from MCD to STAG. Here is the FASTGraph for STAG at the time:

STAG was trading below its normal P/FFO ratio, was paying a 7.4% yield, and seemed a good value with a reasonable margin of safety, so I made the swap.

So while my initial reaction was to regret my sale of MCD, if I look at where the proceeds from that sale were invested, do I still feel regret? Here is an accounting of the Swap:

These are just close approximations, not a perfect accounting, but it's clear that I made a pretty good decision, at least as of today, and I can have a lot less regret over the sale of my MCD holdings.

To summarize my thoughts:

- I still struggle to trim or sell good stocks when their valuations get too high.

- However, if the price of a holding gets disjointed from earnings, I believe trimming, or selling is prudent to de-risk the portfolio and protect against inevitable corrections.

- Especially if I can find an alternative on my watch list of sufficient quality with a more attractive valuation, dividend, and margin of safety.

- And I can't simple consider how much money I "lost" selling a rising stock, I have to consider where the proceeds were redeployed.

And perhaps most importantly, I've learned that keeping both an historical record of my trades, and an up to date watch/wish list of quality stocks is really important to my investment success. My swap above would have been difficult without the latter, and this article, and a reminder of why I made the sale, would have been difficult without the former!

Thursday, April 27, 2017

Really Nice Ryan Leaf "Letter to Self"

From The Players Tribune:

https://www.theplayerstribune.com/ryan-leaf-nfl-letter-to-my-younger-self/?utm_medium=email&utm_campaign=April%2027%20AM&utm_content=April%2027%20AM+CID_cc4ab55e7ab9c52208b270cf6c2ca318&utm_source=newsletter&utm_term=Letter%20to%20My%20Younger%20Self

Nice perspective.

Chump

https://www.theplayerstribune.com/ryan-leaf-nfl-letter-to-my-younger-self/?utm_medium=email&utm_campaign=April%2027%20AM&utm_content=April%2027%20AM+CID_cc4ab55e7ab9c52208b270cf6c2ca318&utm_source=newsletter&utm_term=Letter%20to%20My%20Younger%20Self

Nice perspective.

Chump

Continuing to Add KIMCO Realty Trust (KIM). Also added some SPG

Down 5% since I started my position, now trading around $21/share. 5.1% yield, undervalued with nice steady growth projected.

FastGraph here:

Nice low P/FFO multiple, solid balance sheet and credit rating, I like this stock. Don't love the sector, retail shopping malls, but that is why this stock is underpriced. Recent bad news for brick and mortar retailers (Sears, JCPenney, etc...) has this segment underpriced. But KIM focuses only on the very high end of this sector, and is much more insulated from the internet threat.

Another name I like here is Simon Property Group, SPG. I added a 1/3 position in this stock yesterday for the same reasons....

Best,

Chump

FastGraph here:

Nice low P/FFO multiple, solid balance sheet and credit rating, I like this stock. Don't love the sector, retail shopping malls, but that is why this stock is underpriced. Recent bad news for brick and mortar retailers (Sears, JCPenney, etc...) has this segment underpriced. But KIM focuses only on the very high end of this sector, and is much more insulated from the internet threat.

Another name I like here is Simon Property Group, SPG. I added a 1/3 position in this stock yesterday for the same reasons....

Best,

Chump

Tuesday, April 18, 2017

Good Article from Dennis Prager

http://www.dennisprager.com/two-weeks-of-great-clarity/

If you prize clarity, then these past weeks were some of the best in memory.

1. When America leads, the world is better.

For the first time in eight years, the allies of America and the world’s decent people celebrated America’s return to leadership. Just about all of them understand that if the United States doesn’t exercise its power, the worst regimes on Earth will.

The left claims to care about the downtrodden of the world, but this concern is a moral fraud. The downtrodden the left most care about are American blacks, women and gays. And Palestinians. But these groups aren’t downtrodden; they are merely a vehicle by which the left attacks America and Israel to gain power. The truly downtrodden — that is, the most oppressed people in the world, such as Christians living in the Middle East, and the victims of Syrian President Bashar Assad’s tyranny — know who really cares about them: Trump and America’s conservatives.

2. The terrible presidency of Barack Obama is beginning to be acknowledged.

Following President Trump’s order to attack Syria about 63 hours after the Syrian regime seemingly used chemical weapons, even many in the mainstream media couldn’t help but contrast his prompt response with Obama’s nonresponse to Assad’s use of chemical weapons in 2013. And almost every report further noted that Obama failed to do anything after having promised that he would regard the use of chemical weapons by Assad as crossing a “red line.”

Likewise, Obama’s do-nothing policies vis-a-vis North Korea are being contrasted with Trump’s warnings to leader Kim Jung Un about further testing of intercontinental ballistic missiles and pressure on China’s leaders to rein in the North Korean regime.

These contrasts are important for a number of reasons, not the least of which being there is now hope that Obama’s star will dim as time goes on.

This will come as somewhat of a surprise to those on the left, but many of us who are not on the left believe that Obama did more damage to America than any previous president — economically, militarily and socially.

Regarding the social damage, as the first black president in American history, he could have been an unprecedented force for racial healing but instead left America more racially divided than any modern president. In his repeated citing of Ferguson, for example, he helped spread the lie that a racist white Missouri police officer had killed an innocent black teenager without reason (other than racial bias).

He deceived the American people (the “if you like your doctor, you can keep your doctor” assertion and more) in order to pass Obamacare, one of the largest government-expanding programs in American history. He used presidential power in an unprecedentedly authoritarian manner. He showed far more understanding of the Iranian theocracy than of the Israeli democracy. His Internal Revenue Service and Department of Justice were politicized in ways reminiscent of corrupt Third World regimes. And he left America fighting a (thus far nonviolent) second Civil War.

3. The interminably repeated left-wing lie that Trump and Russian President Vladimir Putin are in cahoots has exploded. With Trump’s military attack on Assad and verbal attacks on Russia, that claim has been shown to be what those with a little common sense knew it to be: a baseless, wholly made-up conspiracy theory meant to explain an election loss with which Democrats still haven’t come to grips. In fact, President Trump has shown more backbone with Russia in his first 100 days in office than President Obama did in eight years.

4. Another charge made over and over by the left — the mainstream media, academia and the Democratic Party — that the Trump election had unleashed an unprecedented amount of anti-Semitism was proven to be yet another left-wing hysteria based on a left-wing lie. It turned out that bomb threats phoned into Jewish community centers and Jewish agencies came not from Trump supporters and “white supremacists” but from a black radical and a disturbed young American Jew living in Israel.

Given that factual and moral clarity are conservatism’s greatest allies, we may be witnessing the beginning of a conservative Renaissance, the likes of which we haven’t seen since the advent of progressivism.

This column was originally posted on Townhall.com.

Monday, March 27, 2017

Adding TROW (T. Rowe Price)

I put TROW onto my watch list several months ago. I set a target buy price of $68. I started a 1/2 position in TROW at $67.64 today. Morningstar rates TROW a 4 Star value, and the FASTGraph below is compelling:

TROW has a nice dividend yield of 3.4%, no debt, and has been increasing the dividend for many years. At a PE of 14 vs. a normal PE of 20, it looks like a good bargain. I put another buy price into my watch list at a 5% discount from today. If it hits that in the coming weeks, I'll add more.

Best,

Chump

TROW has a nice dividend yield of 3.4%, no debt, and has been increasing the dividend for many years. At a PE of 14 vs. a normal PE of 20, it looks like a good bargain. I put another buy price into my watch list at a 5% discount from today. If it hits that in the coming weeks, I'll add more.

Best,

Chump

Wednesday, March 8, 2017

Buying KIM for the IRA, Adding KR (Kroger) to my Taxable Account

Many of my high yield holdings are down today in anticipation of an interest rate hike. As a result, KIM (Kimco) had dipped below my target buy price. KIM is a high end mall REIT, and somewhat impervious to the assault posed by Amazon and the internet. KIM has a nice high yield of 4.7%, and is now at a nice valuation to start a position.

Here is the FASTGraph:

I put a limit order in at $22.18, we'll see if it fills....

Regarding KR (Kroger), this stock got onto my radar due to my youngest daughter. After opening brokerage accounts for all of my three children, they started looking at stocks. They brainstormed stores and companies with which they did business, checked to see if publicly traded, then looked at a FASTGraph for each.

My daughter mentioned she really liked to shop at Ralph's, "they have everything." Ralph's is owned by Kroger. The FASTGraph for KR is shown here:

Turns out KR is big, with $115B in sales in 2016. The valuation is good, and they've paid a growing dividend now for 10+ years. Good pick.

Due to the yield of 1.7%, I've added it to my taxable account, where I hold stocks with lower yields for tax purposes.

That's all for now,

Chump

Here is the FASTGraph:

I put a limit order in at $22.18, we'll see if it fills....

Regarding KR (Kroger), this stock got onto my radar due to my youngest daughter. After opening brokerage accounts for all of my three children, they started looking at stocks. They brainstormed stores and companies with which they did business, checked to see if publicly traded, then looked at a FASTGraph for each.

My daughter mentioned she really liked to shop at Ralph's, "they have everything." Ralph's is owned by Kroger. The FASTGraph for KR is shown here:

Turns out KR is big, with $115B in sales in 2016. The valuation is good, and they've paid a growing dividend now for 10+ years. Good pick.

Due to the yield of 1.7%, I've added it to my taxable account, where I hold stocks with lower yields for tax purposes.

That's all for now,

Chump

Thursday, February 16, 2017

Should I Buy Coke (KO)? And a Michael Lewis book recommendation.

This is a trick question, I already own KO. I just finished an interesting book by Michael Lewis entitled "The Undoing Project: A Friendship That Changed Our Minds.." Mr. Lewis is the author of some really interesting titles including:

Coke's stock has increased around 20% over the past 5 years, but trails the S&P 500 over that same period by a wide margin, which is pretty disappointing.

Here is the FastGraph for KO:

- The Big Short

- Liar's Poker

- Flash Boys

- Moneyball

- Boomerang

- The Blind Side

In the undoing project, he tells the story of two prominent Israeli Psychologists, Daniel Kahneman and Amos Tversky, and their work on how humans think and make decisions.

One of my takeaways is that humans aren't very good at making data driven decisions, and are influenced strongly by bias. Among the many biases discussed, was framing.

"Should I Buy Coke," feels very different that "Should I sell Coke," but it shouldn't. The data is the same in either direction, yet, I've owned Coke now for nearly five years, and I've grown attached to its brand, history, dividend growth, and I really don't want to sell my shares.

Yet, if you ask me whether you should invest in Coke today, I would likely tell you no; there are better opportunities out there based on today's valuation, Coke's pathetic growth, and the long term prospects of sugary drinks overall. And while the dividend is okay, heck, you get a bigger dividend from several utilities, and they are growing faster than Coke!

Coke's stock has increased around 20% over the past 5 years, but trails the S&P 500 over that same period by a wide margin, which is pretty disappointing.

Here is the FastGraph for KO:

It's suffered four straight years of declining earnings and revenue, is moderately overpriced today, and is forecasting another 2% decline in earnings for 2017... not much to get excited about.

Thus my bias, if I know based on the data that Coke is not a great investment, and that I can name several better opportunities (SO, DUK, PFE, STAG to name a few), SO WHY DON'T I SELL? I would never buy a stock with the fundamentals of Coke today....yet I hesitate to sell for some reason. Another concept in the book is the strength of the emotion "regret." If I sell, and something good happens to catalyze growth at Coke, I will suffer regret, which would be much worse than if I simply stick with Coke, and nothing good ever happens.

It seems we humans prefer the slow loss of our investment over many years, or long periods of underperformance, to the threat of a sharp dose of regret.

Thus my bias, if I know based on the data that Coke is not a great investment, and that I can name several better opportunities (SO, DUK, PFE, STAG to name a few), SO WHY DON'T I SELL? I would never buy a stock with the fundamentals of Coke today....yet I hesitate to sell for some reason. Another concept in the book is the strength of the emotion "regret." If I sell, and something good happens to catalyze growth at Coke, I will suffer regret, which would be much worse than if I simply stick with Coke, and nothing good ever happens.

It seems we humans prefer the slow loss of our investment over many years, or long periods of underperformance, to the threat of a sharp dose of regret.

Food for thought.

Chump

Monday, February 13, 2017

Started a Position in Pfizer (PFE)

More to come soon. Good valuation, good dividend around 4%, good place to park some cash.

FastGraph below:

I have a larger than normal cash position in the portfolio due to the sale of three stocks in 2017, CSX, IBM, and DOV, all of which have had nice run ups since the election.

I'll look to add more to PFE if the stock drops 5% from where I bought it.....

That's all for now,

Chump

FastGraph below:

I have a larger than normal cash position in the portfolio due to the sale of three stocks in 2017, CSX, IBM, and DOV, all of which have had nice run ups since the election.

I'll look to add more to PFE if the stock drops 5% from where I bought it.....

That's all for now,

Chump

Monday, January 30, 2017

Some (much needed) Facts About President Trump's Immigration Order

Some good information from ZeroHedge:

Kellyanne Conway Rages Against "Misinformation" Over Trump's Immigration Order

"The media and politicians have an obligation to calm the public [with facts] about what this policy does, and more importantly does not, do... this is why [Trump] has to tweet, so that the media will cover the tweet [facts]"

Additionally, in an effort to dispel some more misinformation, Breitbart offers seven inconvenient facts about Trump's refugee actions...

1. It is NOT a “Muslim ban.” You will search the Executive Order in vain for mentions of Islam, or any other religion. By Sunday morning, the media began suffering acute attacks of honesty and writing headlines such as “Trump’s Latest Executive Order: Banning People From 7 Countries and More” (CNN) and printing the full text of the order.

Granted, CNN still slips the phrase “Muslim-majority countries” into every article about the order, including the post in which they reprinted its text in full, but CNN used the word “Muslim,” not Trump. The order applies to all citizens of Iraq, Iran, Syria, Libya, Somalia, Sudan, and Yemen. It does not specify Muslims. The indefinite hold on Syrian refugees will affect Christians and Muslims alike.

As Tim Carney at the Washington Examiner points out, the largest Muslim-majority countries in the world are not named in the Executive Order.

More countries may be added to the moratorium in the days to come, as the Secretary of Homeland Security has been instructed to complete a 30-day review of nations that don’t provide adequate information for vetting visa applicants.

It’s also noteworthy that the ban is not absolute. Exceptions for “foreign nationals traveling on diplomatic visas, North Atlantic Treaty Organization visas, C-2 visas for travel to the United Nations, and G-1, G-2, G-3, and G-4 visas” are expressly made in the order. The Departments of State and Homeland Security can also grant exceptions on a “case-by-case basis,” and “when in the national interest, issue visas or other immigration benefits to nationals of countries for which visas and benefits are otherwise blocked.”

There is a provision in the Executive Order that says applications based on religious persecution will be prioritized “provided that the religion of the individual is a minority religion in the individual’s country of nationality.”

This has been denounced as a “stealth Muslim ban” by some of the very same people who were conspicuously silent when the Obama administration pushed Christians – who the most savagely persecuted minority in the Middle East, with only the Yazidis offering real competition — to the back of the migration line.

2. The order is based on security reviews conducted by President Barack Obama’s deputies. As White House counselor Kellyanne Conway pointed out on “Fox News Sunday,” the seven nations named in Trump’s executive order are drawn from the Terrorist Prevention Act of 2015. The 2015 “Visa Waiver Program Improvement and Terrorist Travel Prevention Act of 2015” named Iraq, Iran, Sudan, and Syria, while its 2016 update added Libya, Somalia, and Yemen.

“These are countries that have a history of training, harboring, exporting terrorists. We can’t keep pretending and looking the other way,” said Conway.

3. The moratorium is largely temporary. Citizens of the seven countries named as security risks are banned from entering the United States for the next 90 days. Refugee processing is halted for 120 days. The longest-lived aspect of the ban may prove to be the halt on Syrian refugees, but that isn’t given a time frame at all. It will last “until such time as I have determined that sufficient changes have been made to the USRAP to ensure that admission of Syrian refugees is consistent with the national interest,” as President Trump wrote.

4. Obama banned immigration from Iraq, and Carter banned it from Iran. “Fact-checking” website PolitiFact twists itself into knots to avoid giving a “true” rating to the absolutely true fact that Jimmy Carter banned Iranian immigration in 1980, unless applicants could prove they were enemies of the Khomenei theocracy.

One of Politifact’s phony talking points states that Carter “acted against Iranian nationals, not an entire religion.” As noted above, Trump’s Executive Order is precisely the same – it does not act against an “entire religion,” it names seven countries.

As for Barack Obama, he did indeed ban immigration from Iraq, for much longer than Trump’s order bans it from the seven listed nations, and none of the people melting down today uttered a peep of protest. Richard Grenell summed it up perfectly in a Tweet:

Obama took 6 months to review screening for 1 country. Trump will take 3 months for 7 countries. #MAGA @realDonaldTrump

5. Trump’s refugee caps are comparable to Obama’s pre-2016 practices: David French, who was touted as a spoiler candidate to keep Donald Trump out of the White House during the presidential campaign – in other words, not a big Trump fan – wrote a lengthy and clear-headed analysis of the Executive Order for National Review. He noted that after the moratorium ends in 120 days, Trump caps refugee admissions at 50,000 per year… which is roughly the same as President Obama’s admissions in 2011 and 2012, and not far below the 70,000 per year cap in place from 2013 to 2015.

Obama had fairly low caps on refugees during the worst years of the Syrian civil war. He didn’t throw open the doors to mass refugee admissions until his final year in office. Depending on how Trump’s review of Syrian refugee policy turns out, he’s doing little more than returning admissions to normal levels after a four-month pause for security reviews.

6. The Executive Order is legal: Those invoking the Constitution to attack Trump’s order are simply embarrassing themselves. The President has clear statutory authority to take these actions. As noted, his predecessors did so, without much controversy.

Most of the legal arguments against Trump’s order summarized by USA Today are entirely specious, such as attacking him for “banning an entire religion,” which the order manifestly does not do. Critics of the order have a political opinion that it will in effect “ban Muslims,” but that’s not what it says. Designating specific nations as trouble spots and ordering a pause is entirely within the President’s authority, and there is ample precedent to prove it.

It should be possible to argue with the reasoning behind the order, or argue that it will have negative unintended consequences, without advancing hollow legal arguments. Of course, this is America 2017, so a wave of lawsuits will soon be sloshing through the courts.

7. This Executive Order is a security measure, not an arbitrary expression of supposed xenophobia. Conway stressed the need to enhance immigration security from trouble spots in her “Fox News Sunday” interview. French also addressed the subject in his post:

When we know our enemy is seeking to strike America and its allies through the refugee population, when we know they’ve succeeded in Europe, and when the administration has doubts about our ability to adequately vet the refugees we admit into this nation, a pause is again not just prudent but arguably necessary. It is important that we provide sufficient aid and protection to keep refugees safe and healthy in place, but it is not necessary to bring Syrians to the United States to fulfill our vital moral obligations.

French’s major objection to the Executive Order is that applying it to green-card holders is “madness,” but unfortunately many of the terrorists who attacked Americans during the Obama years were green-card holders. Daniel Horowitz and Chris Pandolfo addressed that subject at Conservative Review:

Both liberals and conservatives expressed concern over hundreds of individuals going over to fight for ISIS. We are already limited in how we can combat this growing threat among U.S. citizens. Given that it is completely legal to exclude non-citizens upon re-entry, Trump extended the ban to legal permanent residents as well.If a Somali refugee is travelling back to Somalia (so much for credible fear of persecution!), government officials should have the ability to prevent that person from coming back when necessary. Obviously, there are some individuals from these seven countries who already have green cards and we might not want to exclude. That is why the order grants discretion to the State Department to issue case-by-case exemptions for “religious persecution, “or when the person is already in transit and denying admission would cause undue hardship.” A CBP agent is always stationed at any international airport from which these individuals would board a direct flight to the United States (Paris and Dubai, for example). That individual would not allow anyone covered by this ban onto a U.S.-bound flight unless he grants them a hardship exemption.Indeed, it appears that green card holders returning yesterday from those seven countries were all granted entry.

Because he is a progressive globalist, Obama deliberately blinded us to security threats, in the name of political correctness and left-wing ideology. Ninety or 120 days isn’t much time for Trump to turn all that around, especially because it is unlikely much will change in the seven countries Trump named.

The hysterical reaction to Trump’s order illustrates the very thing that worries advocates of strong immigration security: Americans’ security is the lowest priority, far below progressive ideology, crass political opportunism, and emotional theater.

We’re being effectively told by the theatrical class to tolerate a certain amount of Islamic terrorism because their feelings would be hurt by the tough measures we need protest ourselves from a tough enemy. But this time, President Trump is proving tough enough to push our security up into the top priority.

Subscribe to:

Posts (Atom)