Every time I look at my stock holdings and my watch list, I see MCD making new highs, which causes me some angst. This past February, after reading a book by Michael Lewis, I wrote an article about selling stocks (here: https://seekingalpha.com/article/4049789-buy-coke-interesting-book-recommendation) and how regret is such a strong emotion for investors, and how it can keep us from making smart investment decisions.

Should I regret selling MCD back in late 2015? The quick and easy answer is yes, I sold it at around $118, and today it's trading above $140, what a Chump I am!

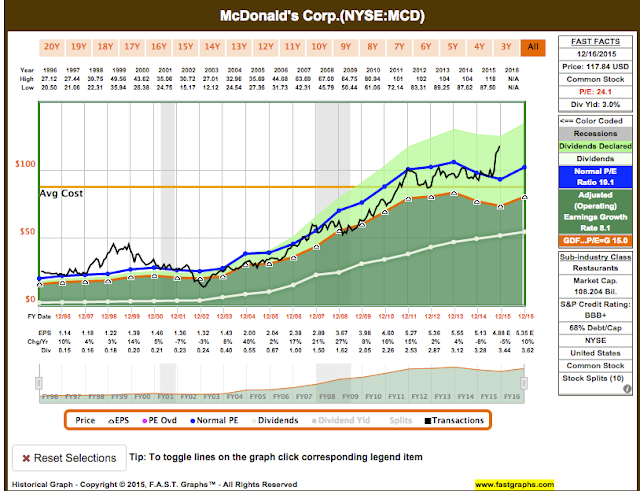

But wait, if you look more deeply at the decision, which would be impossible to do without a diary, log, or in my case, a blog, the story changes. Going back to my blog post from December 2015, I was concerned about the valuation of MCD. Looking at the FASTGraph for MCD from that time, I was right to be a little worried:

The price and PE had become disjointed from their earnings. In short, MCD was becoming a risky hold, and in my opinion, was likely to revert to a more normal historical PE in the coming year, from the then current PE 24 down to a more normal PE 19.

However, because I dislike selling quality stocks, I was inclined to hold on to MCD and continue to collect the dividend, unless I could identify a more attractive alternative. The fear of regret was holding my back! I was imagining selling MCD, then watching it go to $140!

At about this same time, I was reviewing my watch list favorable alternatives. I had read a good article by Brad Thomas, actually several, touting the virtues of a REIT called Stag Industrial, so it was on my watch list. (As an interesting aside, I noticed Brad has written about STAG 32 times on SA. The only REITs with more coverage from Brad are O and VER) After doing some research, I determined that I would shift by investment from MCD to STAG. Here is the FASTGraph for STAG at the time:

STAG was trading below its normal P/FFO ratio, was paying a 7.4% yield, and seemed a good value with a reasonable margin of safety, so I made the swap.

So while my initial reaction was to regret my sale of MCD, if I look at where the proceeds from that sale were invested, do I still feel regret? Here is an accounting of the Swap:

These are just close approximations, not a perfect accounting, but it's clear that I made a pretty good decision, at least as of today, and I can have a lot less regret over the sale of my MCD holdings.

To summarize my thoughts:

- I still struggle to trim or sell good stocks when their valuations get too high.

- However, if the price of a holding gets disjointed from earnings, I believe trimming, or selling is prudent to de-risk the portfolio and protect against inevitable corrections.

- Especially if I can find an alternative on my watch list of sufficient quality with a more attractive valuation, dividend, and margin of safety.

- And I can't simple consider how much money I "lost" selling a rising stock, I have to consider where the proceeds were redeployed.

And perhaps most importantly, I've learned that keeping both an historical record of my trades, and an up to date watch/wish list of quality stocks is really important to my investment success. My swap above would have been difficult without the latter, and this article, and a reminder of why I made the sale, would have been difficult without the former!

No comments:

Post a Comment