Here is a FASTGraph for DOV:

The price has had nice appreciation in 2016, like many of the oil/energy sector stocks in anticipation of improved pricing. That said, the pricing isn't improved yet, and the price of DOV stock has outrun earnings by several years.

Below is an earnings forecast overlaid with the price:

Even if the price of oil rebounds, and DOV hits this earnings forecast, it's still priced too high! Owning DOV today is too risky, and likelihood of some downside to the price is strong.

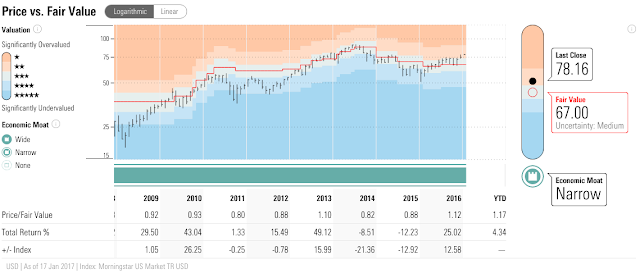

Below is a chart from Morningstar showing fair value for DOV, again, it's currently overpriced:

Closing the position today, looking for a better near term investment with the proceeds.

As I stated in my last post, I have too many positions in the portfolio. With this sale, I'm down to 34 positions, and may deploy the money into one or more of my current portfolio holdings. Further, as I stated after 2015, its good to close positions when they become dangerously overvalued, and not get too attached to any specific holding.

Best regards,

Chump

No comments:

Post a Comment